Changing how Points and Fees are Calculated and Applied for Qualified Mortgages (H.R. 685)

Do you support or oppose this bill?

What is H.R. 685?

(Updated May 6, 2020)

This bill would amend the Truth in Lending Act to change the definition of "points" and "fees" and how they’re applied to qualified mortgages under the Consumer Financial Protection Bureau (CFPB) regulations.

For those of you who don't have a mortgage: Under the CFPB, a "qualified mortgage" has facets that make the loan more affordable for borrowers, because those borrowers have demonstrated in one way or another that they can repay the loan. As the CBO explains in an analysis of this bill:

"Certain costs that are incidental to the loan amount and are paid by the borrower — for example, title insurance fees, guarantee fees, and service charges — are limited to no more than 3 percent of the total loan amount."

This bill would remove from that 3 percent limit calculation (the points and fees that we mentioned before): insurance premiums held in escrow, creditor company (or mortgage originator) fees, and loan level price adjustment payments set by Fannie Mae, Freddie Mac, the Federal Housing Administration, or other related government sponsored enterprise.

Within 90 days after this legislation’s enactment the CFPB would issue final regulations to carry out the amendments in this bill, which would be effective upon issuance.

Argument in favor

Improves access to credit and qualified mortgages for low- and middle-income borrowers. More people would have access to a qualified mortgage, and this would in turn, be a step toward the revitalization of the U.S. housing market.

Argument opposed

This bill weakens mortgage reform, undermines consumer protection, and incentivizes lenders to steer families into high-risk, high-fee loans that they don't understand and can't afford, effectively recreating one of the catalysts for the 2007-08 financial crisis.

Impact

Low- and middle-income borrowers seeking to buy a house via a qualified mortgage, mortgage loan originators, U.S. banks, and the Federal Housing Administration.

Cost of H.R. 685

A CBO cost estimate found that the spending associated with implementing this bill would have an insignificant impact on federal spending or the nation's budget.

Additional Info

In-Depth:

A previous version of this bill was introduced in the House with bipartisan support in September 2013. It passed the House with a voice vote, but stalled in the Senate.

Of Note:

Sponsoring Rep. Bill Huizenga (R-MI) said that his bill “is narrowly focused to promote access to affordable mortgage credit without overturning the important consumer protections and sound underwriting required by Dodd-Frank’s ‘ability to re-pay’ provisions.”

In an op-ed, Sen. Elizabeth Warren (D-MA) and Rep. Maxine Waters (D-CA) claimed that this bill would “re-create incentives to steer families into high-risk, high-fee loans they do not understand and cannot afford.”

Media:

Sponsoring Rep. Bill Huizenga (R-MI) Press Release

Op-Ed by Sen. Elizabeth Warren (D-MA) and Rep. Maxine Waters (D-CA) (Opposed)

Americans United for Change (Opposed)

Credit Union Times (In Favor)

National Association of Realtors (In Favor)

Summary by Eric Revell

(Photo Credit: Flickr user adam wiseman)

The Latest

-

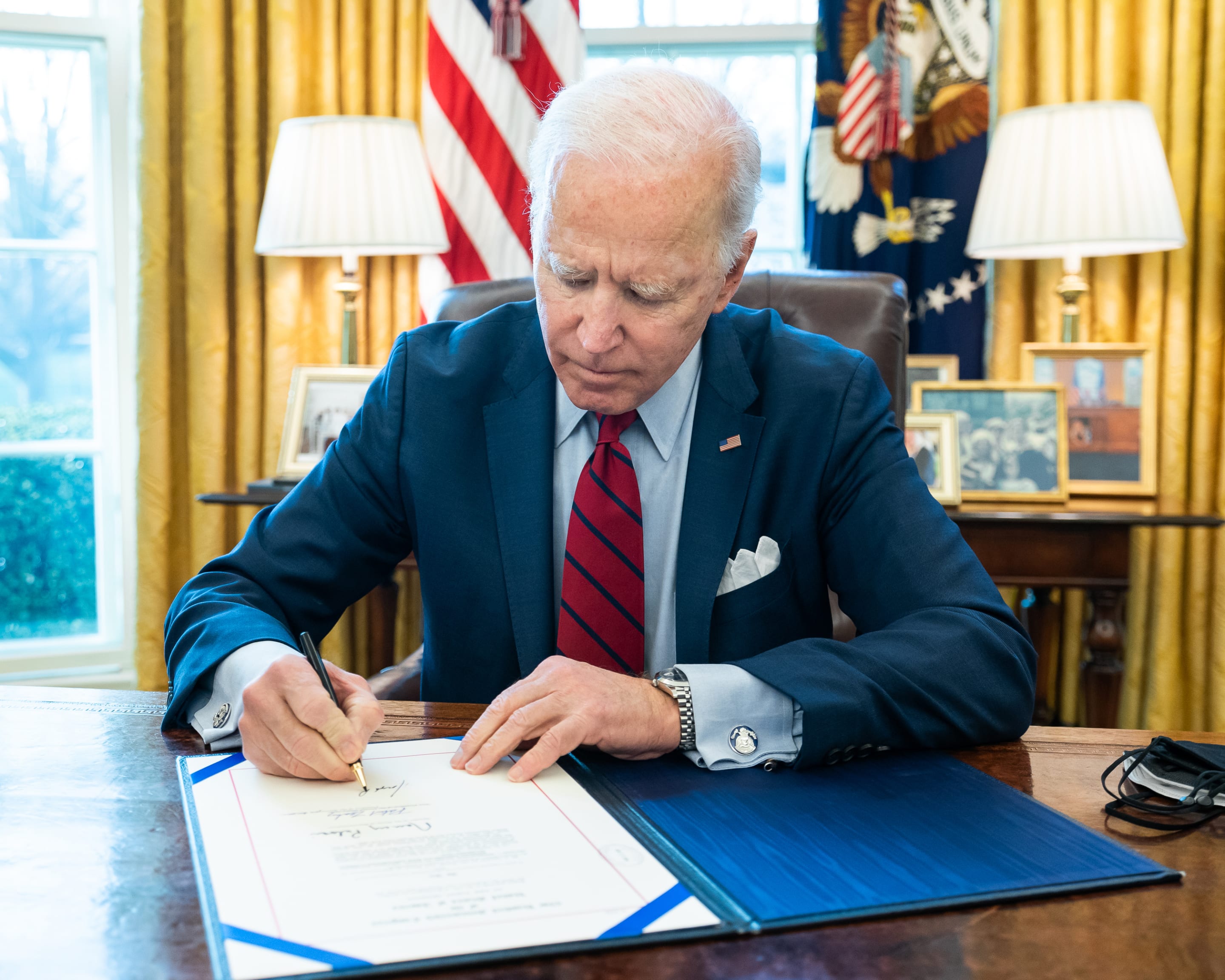

IT: 🖋️ Biden signs a bill approving military aid and creating hurdles TikTok, and... Should the U.S. call for a ceasefire?Welcome to Thursday, April 25th, readers near and far... Biden signed a bill that approved aid for Ukraine, Israel, and Taiwan, read more...

IT: 🖋️ Biden signs a bill approving military aid and creating hurdles TikTok, and... Should the U.S. call for a ceasefire?Welcome to Thursday, April 25th, readers near and far... Biden signed a bill that approved aid for Ukraine, Israel, and Taiwan, read more... -

Biden Signs Ukraine, Israel, Taiwan Aid, and TikTok BillWhat’s the story? President Joe Biden signed a bill that approved aid for Ukraine, Israel, and Taiwan, which could lead to a ban read more... Taiwan

Biden Signs Ukraine, Israel, Taiwan Aid, and TikTok BillWhat’s the story? President Joe Biden signed a bill that approved aid for Ukraine, Israel, and Taiwan, which could lead to a ban read more... Taiwan -

Protests Grow Nationwide as Students Demand Divestment From IsraelUpdated Apr. 23, 2024, 11:00 a.m. EST Protests are growing on college campuses across the country, inspired by the read more... Advocacy

Protests Grow Nationwide as Students Demand Divestment From IsraelUpdated Apr. 23, 2024, 11:00 a.m. EST Protests are growing on college campuses across the country, inspired by the read more... Advocacy -

IT: Here's how you can help fight for justice in the U.S., and... 📱 Are you concerned about your tech listening to you?Welcome to Thursday, April 18th, communities... Despite being deep into the 21st century, inequity and injustice burden the U.S. read more...

IT: Here's how you can help fight for justice in the U.S., and... 📱 Are you concerned about your tech listening to you?Welcome to Thursday, April 18th, communities... Despite being deep into the 21st century, inequity and injustice burden the U.S. read more...

Climate & Consumption

Climate & Consumption

Health & Hunger

Health & Hunger

Politics & Policy

Politics & Policy

Safety & Security

Safety & Security