Should Tax Deductions for Startups be Expanded? (H.R. 6756)

Do you support or oppose this bill?

What is H.R. 6756?

(Updated September 24, 2020)

This bill — known as the American Innovation Act of 2018 — would seek to to spur innovation by helping brand-new businesses with startup costs and capital by expanding tax deductions available to them. A breakdown of its three main components can be found below.

The bill would consolidate tax rules to allow startups to deduct up to $20,000 of startup and organizational costs from annual tax filings. Currently, the deduction limit is $5,000 each for startup and organizational costs. Expenses that can’t be deducted immediately would be amortized over 180 months.

It’d also allow small businesses that are completely liquidated before the end of the 180-month period to have any unamortized amounts deducted to the extent allowable by law. In the case of any active trade or business that’s completely disposed of or discontinued before the end of the 180-month period, any unamortized startup expenditures may be deducted to the extent allowable under law.

Additionally, new companies that experience changes in ownership would be eligible to claim certain tax breaks that were previously limited. Specifically, a startup business’ pre-change net operating loss carryforwards, net operating losses, general business credit carryforwards, and general business credits would be available for use in a post-change year. Currently, an ownership change subjects a company to significant limitations.

Argument in favor

Small businesses make major contributions to the U.S. economy’s innovation and productivity. Supporting them via tax breaks will encourage their formation and success, benefiting both business owners and workers while promoting economic growth.

Argument opposed

America's debt burden is already tremendous, and this bill will cost over $5 billion in lost tax revenue. Additionally, small businesses, like larger corporations, already received tax relief in last year’s GOP tax bill.

Impact

Small businesses; startups; tax code; and the Internal Revenue Service.

Cost of H.R. 6756

The CBO estimates that enacting this bill would reduce tax revenue by $5.4 billion over the 2019-2028 period.

Additional Info

In-Depth: House Ways and Means Committee Chairman Rep. Kevin Brady (R-TX) offered the following statement in support of Rep. Vern Buchanan’s (R-FL) bill to provide tax relief to startups as a way of encouraging economic growth:

“The American Innovation Act will increase innovation by helping new entrepreneurs move from the kitchen table to Main Street and beyond. The country that wins the innovation race wins the future, and it’s time for our tax code to help us get there. Last year we said goodbye to America’s old, broken tax code. Under our new system, we’re seeing incredible job growth, bigger paychecks, and a tax code that works on behalf of families and American businesses. Now it’s the time to ensure we never let our tax code become so outdated again.”

Rep. Darin LaHood (R-IL), a cosponsor of both this bill and the other two pieces of legislation in Tax Reform 2.0, adds that the full Tax Reform 2.0 package will bolster the American economy as a whole:

“Last year, Republicans reformed our nation’s tax code for the first time in more than 30 years, streamlining the filing process, allowing individuals to keep more of their hard-earned money, and empowering American business to be more competitive around the globe. [Tax Reform 2.0 builds] upon our tax reform successes by advancing legislation that would provide certainty to taxpayers, expand retirement savings for individuals and families, and unleash America’s innovative spirit. This is another step in making certain taxpayers continue to have a tax code that works for them. With take-home pay up 4.9%, wages rising at a rate not seen in nine years, small business optimism at record highs, [and] job creation regularly beating expectations... I look forward to working to get Tax Reform 2.0 passed in the House and to President Trump’s desk, so individuals and families… can continue to see more money in their pockets and our local small businesses can further innovate to stay competitive in a growing global economy.”

Democrats have opposed the Tax Reform 2.0 plan, especially since the discussion on it — like those on Tax Cuts and Jobs Act — have excluded Democrats. Rep. Steny Hoyer (D-MD) said:

“Instead of repeating Republicans’ mistakes from December by considering a second tax bill through another closed process, without any substantive hearings or input from the American people, Democrats have a different approach. Democrats want to do tax reform the right way — in a bipartisan fashion and with a commitment to fiscal sustainability.”

Minority Leader Rep. Nancy Pelosi (D-CA) calls the Republicans’ 2.0 effort “just as destructively tilted toward the wealthiest 1 percent as the original.”

Rep. Leonard Lance (R-NJ) has called Republicans’ attempt to pass further tax cuts through Tax Reform 2.0 an “exercise in futility,” arguing that it would never pass the Senate.

This legislation passed the House Ways and Means Committee by a voice vote with with the support of 26 cosponsors. It also has the support of the The Heartland Institute, the Florida Chamber of Commerce, and the National Federation of Independent Business.

Of Note: Tax Reform 2.0 seeks to expand the Tax Cuts and Jobs Act. It’s a follow-up to House Ways and Means Committee Chairman Kevin Brady’s (R-TX) “listening session framework” released in July 2018. In total, there are three bills in Tax Reform 2.0, including this bill. The other two bills are the Protecting Family and Small Business Tax Cuts Act of 2018 (H.R. 6760) and Family Savings Act of 2018 (HR 6757). In sum, the total tax revenue loss for all three bills in Tax Reform 2.0 is projected to be $657 billion.

In 2018, the U.S. dropped out of Bloomberg’s list of the top 10 most innovative countries in the world. This is a problem, as many believe that the nation that wins the innovation race wins the future.

Media:

-

House Ways and Means Committee Press Release

-

Joint Committee on Taxation

-

CBO Cost Estimate

-

Washington Examiner (Op-Ed In Favor)

-

USA TODAY (Op-Ed Opposed)

Summary by Lorelei Yang

(Photo Credit: iStockphoto.com / skynesher)The Latest

-

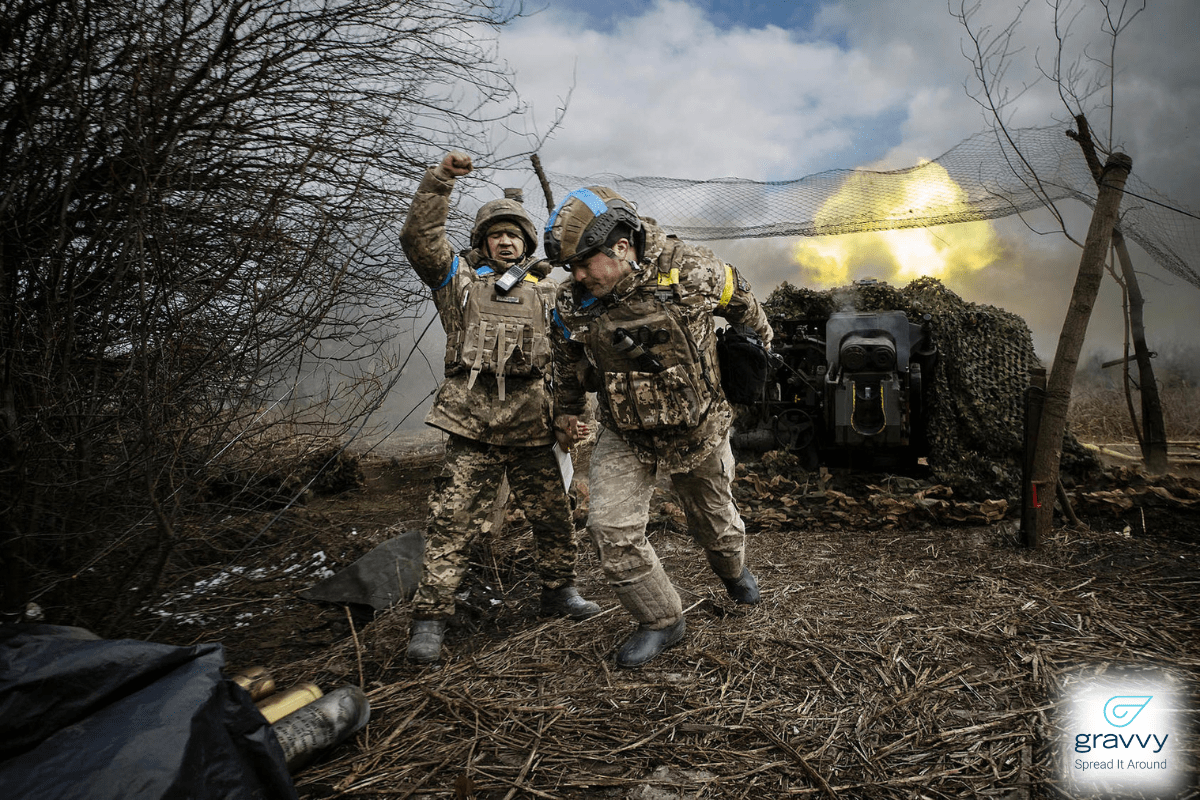

How To Help Civilians in UkraineHeavy shelling and fighting have caused widespread death, destruction of homes and businesses, and severely damaged read more... Public Safety

How To Help Civilians in UkraineHeavy shelling and fighting have caused widespread death, destruction of homes and businesses, and severely damaged read more... Public Safety -

The Latest: Israel Evacuates Rafah, Palestinian Place of RefugeUpdated May 6, 2024, 12:00 p.m. EST The Israeli military is telling residents of Gaza who have sought shelter in Rafah to read more... Israel

The Latest: Israel Evacuates Rafah, Palestinian Place of RefugeUpdated May 6, 2024, 12:00 p.m. EST The Israeli military is telling residents of Gaza who have sought shelter in Rafah to read more... Israel -

Trump Hush Money Trial Enters Third Week, Strategy to ‘Deny, Deny, Deny’Updated May 6, 2024, 11:00 a.m. EST The criminal trial to determine whether Trump is guilty of falsifying records to cover up a read more... Law Enforcement

Trump Hush Money Trial Enters Third Week, Strategy to ‘Deny, Deny, Deny’Updated May 6, 2024, 11:00 a.m. EST The criminal trial to determine whether Trump is guilty of falsifying records to cover up a read more... Law Enforcement -

IT: Battles between students and police intensify, and... 💻 Should we regulate AI access to our private data?Welcome to Thursday, May 2nd, listeners... The battle between protesters and police intensifies on college campuses across the read more...

IT: Battles between students and police intensify, and... 💻 Should we regulate AI access to our private data?Welcome to Thursday, May 2nd, listeners... The battle between protesters and police intensifies on college campuses across the read more...

Climate & Consumption

Climate & Consumption

Health & Hunger

Health & Hunger

Politics & Policy

Politics & Policy

Safety & Security

Safety & Security