Should Oil Companies Be Prohibited From Getting Tax Deductions for Spill Settlements? (H.R. 6658)

Do you support or oppose this bill?

What is H.R. 6658?

(Updated September 2, 2019)

This bill — known as the Offending Oil Polluters Act — would amend the Internal Revenue Code to deny certain tax credits or deductions related to business expenses for settlements, legal fees, penalties, or restitution paid by an “offending oil polluter”. Offending oil polluter would be defined as any person or corporation responsible for a vessel or facility from which oil or a hazardous substance is discharged, as well as any person who is a member of the same expanded affiliated group as the offending oil polluter.

Specifically, it would deny deductions or credits for:

Amounts paid or incurred in connection with a discharge of oil or a hazardous substance;

Attorney fees and court costs in connection with legal actions involving such discharge;

As payment or restitution for oil or hazardous substance discharge; and

Costs or penalties certified in a settlement by a federal court, or required by federal law or regulations.

The Treasury Dept. would be required to report to Congress on: 1) the revenue loss as a result of tax deductions allowed for cleaning up oil discharged after April 19, 2010, and 2) the amount of revenue savings resulting from this bill.

Argument in favor

Corporations shouldn’t be allowed to pass the costs of environmental disasters on to taxpayers by deducting such costs from their tax bills. Taxpayers already pay much of the cost to clean up oil spills — they shouldn’t pay again by subsidizing corporate taxes for companies responsible for these environmental disasters.

Argument opposed

The IRS and agencies that settle with companies already have the authority to determine what is and isn’t tax-deductible in settlements, so there’s no need for this legislation. It would be simpler to require the IRS and agencies to clearly state tax-deductible versus non-tax-deductible parts of settlements when they’re made with corporations.

Impact

Oil companies; polluters; Treasury Department; and the Internal Revenue Code.

Cost of H.R. 6658

A CBO cost estimate is unavailable.

Additional Info

In-Depth: Rep. Eliot Engel (D-NY) introduced this bill to prevent companies from deducting losses that result from spilling oil or hazardous substances:

“BP made an absolute mess in the Gulf, and the idea that they can somehow pawn the bill off on the American taxpayer is disgusting. Those who do significant harm to our environment need to be held accountable to the public for their actions, not the other way around. The current laws provide too many escape hatches for polluters to use in order to avoid paying for the damage they’ve done. This needs to end, which is why we are introducing this piece of legislation to protect the American taxpayer from financial liability.”

Robert Willens, a tax and accounting expert, calls the current system in which corporations frequently deduct settlement costs and other expenses associated with oil spills and other forms of corporate wrongdoing, “a little misleading,” as “in reality [these settlements are] not costing (companies) the headline amount.”

Ryan Pierannunzi, a tax and budget expert with U.S. Public Interest Research Group (U.S. PIRG) adds that there are budgetary consequences, as well:

“When corporations treat the financial payments they must make as a result of their wrongdoing as ordinary costs of doing business, they force taxpayers to pick up the tab. While debate rages over how to address our deficit, we can ill-afford to subsidize the misdeeds of corporations like BP and UBS… The tax treatment of settlements has a very real impact on peoples’ lives. Every dollar that doesn’t get paid to the Treasury means another dollar in debt, cutbacks, or higher taxes that the rest of us must bear.”

This legislation has been introduced in the House with the support of one cosponsor, who is also a Democrat.

Of Note: Congressional interest in oil spill legislation has been on the upswing in the wake of recent oil spills, most notably BP’s Deepwater Horizon spill in the Gulf of Mexico.

Currently, federal tax law prevents companies from deducting penalties paid for breaking the law from their corporate taxes. But money classified as something other than a penalty — including restitution, reimbursement, or compensatory payments to damaged parties — is deductible as an ordinary cost of doing business. As an example of this, 75% of the $20.8 billion settlement BP reached with the Justice Department for damages caused by the 2010 Deepwater Horizon spill was tax-deductible, meaning about $5 billion was deducted from BP’s tax bill.

Additionally, unless the Justice Dept. clearly spells out that settlements like BP’s cannot be deducted, companies that pay such fines and penalties typically deduct them as ordinary business expenses. According to the Government Accountability Office (GAO), corporations often deduct settlement payments even when regulations suggest they shouldn’t, and the issue isn’t pursued by government agencies because they believe tax issues surrounding settlements should be left to the IRS. Meanwhile, the IRS has stated that it’s up to government agencies to determine whether a settlement is or isn’t tax-deductible. This confusion has created a regulatory no-man’s-land where corporations can saddle American taxpayers with part of the costs of their wrongdoing.

Media:

Summary by Lorelei Yang

(Photo Credit: iStockphoto.com / michaelbwatkins)The Latest

-

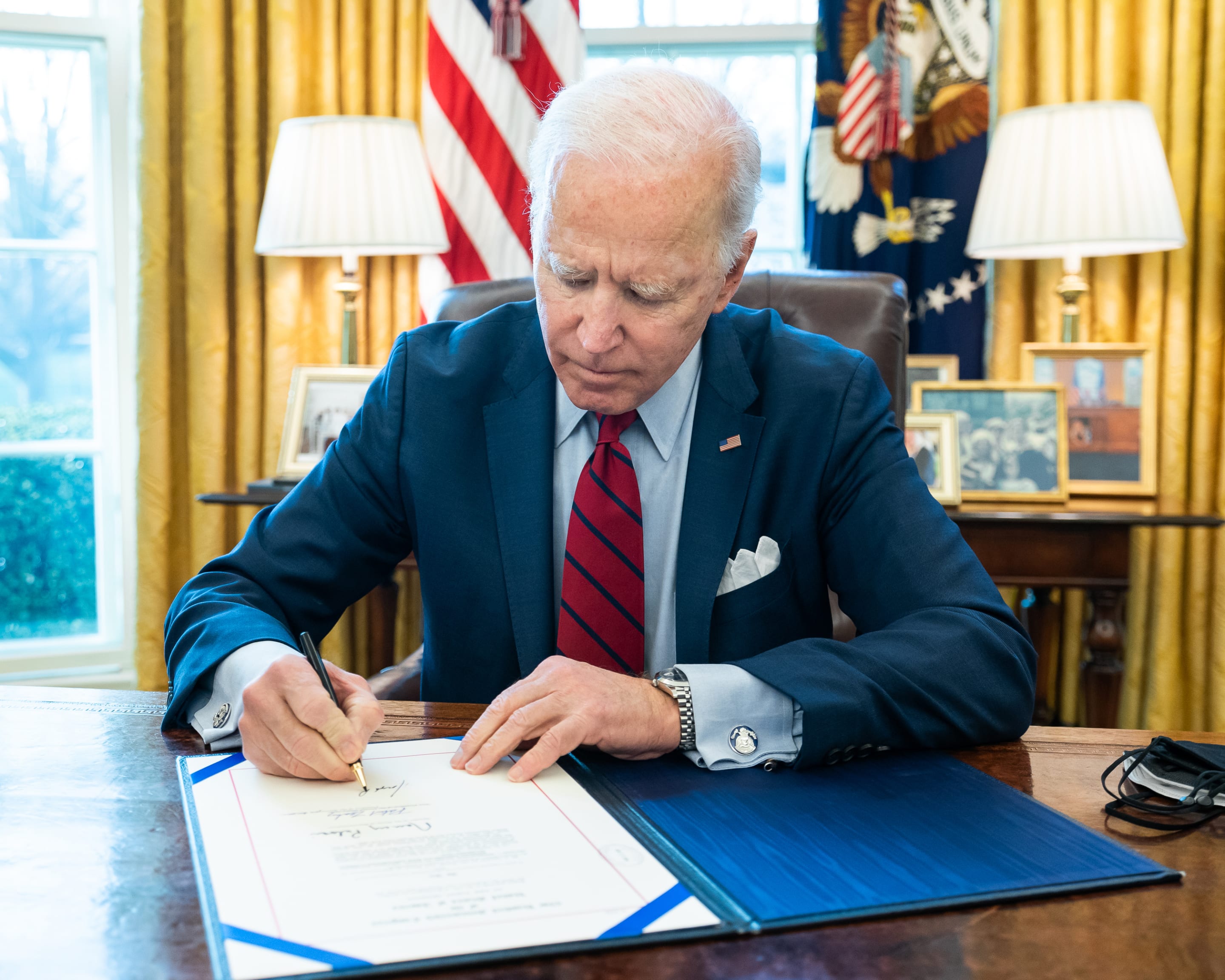

Biden Signs Ukraine, Israel, Taiwan Aid, and TikTok BillWhat’s the story? President Joe Biden signed a bill that approved aid for Ukraine, Israel, and Taiwan, which could lead to a ban read more... Taiwan

Biden Signs Ukraine, Israel, Taiwan Aid, and TikTok BillWhat’s the story? President Joe Biden signed a bill that approved aid for Ukraine, Israel, and Taiwan, which could lead to a ban read more... Taiwan -

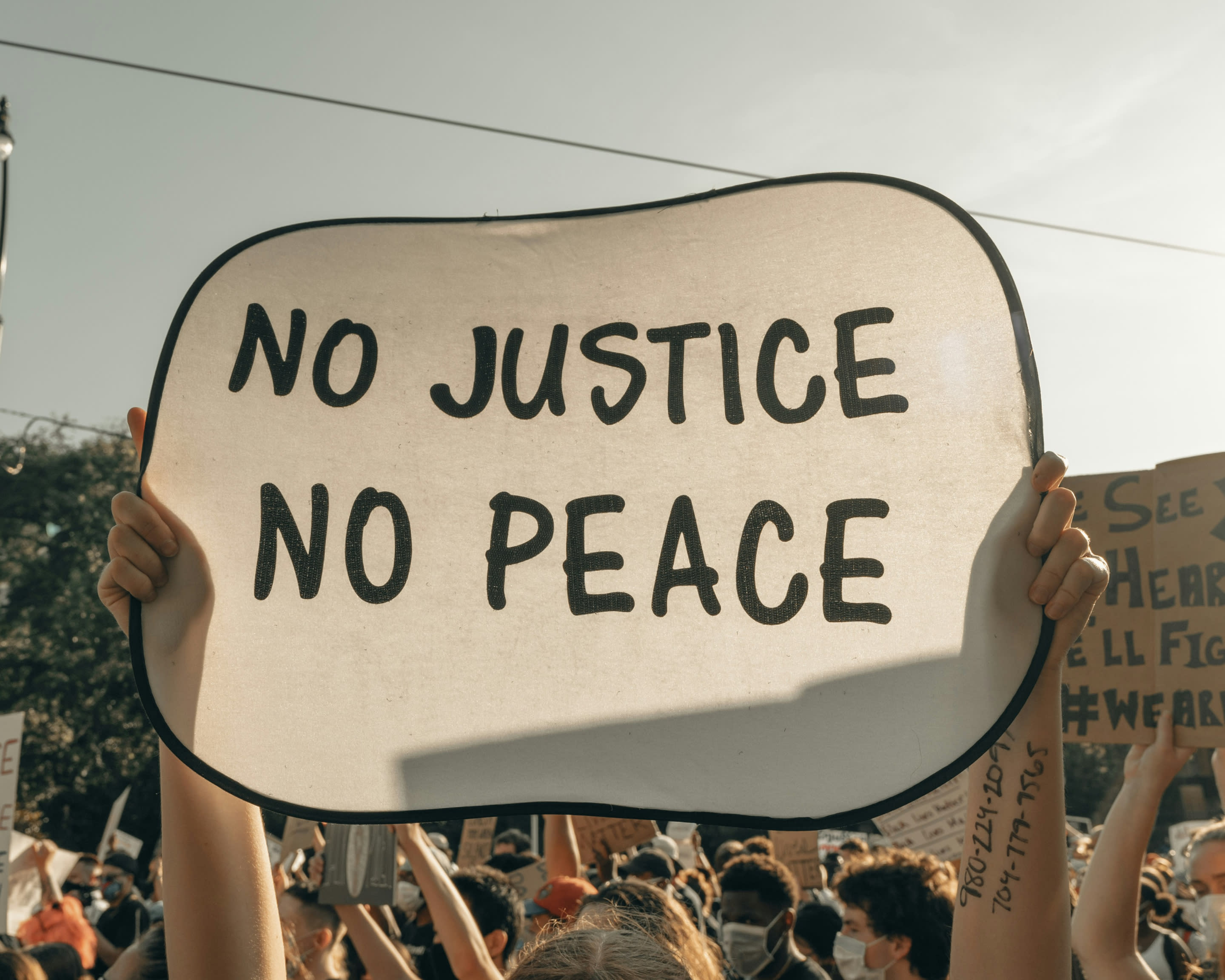

Protests Grow Nationwide as Students Demand Divestment From IsraelUpdated Apr. 23, 2024, 11:00 a.m. EST Protests are growing on college campuses across the country, inspired by the read more... Advocacy

Protests Grow Nationwide as Students Demand Divestment From IsraelUpdated Apr. 23, 2024, 11:00 a.m. EST Protests are growing on college campuses across the country, inspired by the read more... Advocacy -

IT: Here's how you can help fight for justice in the U.S., and... 📱 Are you concerned about your tech listening to you?Welcome to Thursday, April 18th, communities... Despite being deep into the 21st century, inequity and injustice burden the U.S. read more...

IT: Here's how you can help fight for justice in the U.S., and... 📱 Are you concerned about your tech listening to you?Welcome to Thursday, April 18th, communities... Despite being deep into the 21st century, inequity and injustice burden the U.S. read more... -

Restore Freedom and Fight for Justice With GravvyDespite being deep into the 21st century, inequity and injustice burden the U.S., manifesting itself in a multitude of ways. read more... Criminal Justice Reform

Restore Freedom and Fight for Justice With GravvyDespite being deep into the 21st century, inequity and injustice burden the U.S., manifesting itself in a multitude of ways. read more... Criminal Justice Reform

Climate & Consumption

Climate & Consumption

Health & Hunger

Health & Hunger

Politics & Policy

Politics & Policy

Safety & Security

Safety & Security