What is H.R. 4453?

(Updated January 31, 2017)

This bill would permanently cut in half (from 10 years to 5 years), the length of time that S corporations have to pay the built-in gains tax, commonly referred to as the "BIG tax." S corporations, according to the IRS, "are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes." They generally don't pay corporate taxes and are limited to 100 shareholders. C corporations, on the other hand, are taxed separately from, and in addition to, their shareholders. When an S turns into a C, or acquires assets from a C, they have to pay the BIG tax.

The same reductions would also be applied to regulated investment companies and real estate investment funds.

Argument in favor

Would free up S corporations' access to capital, which in turn might help spur economic growth.

Argument opposed

Increases the federal deficit by a billion and a half over the next decade.

Impact

The bill affects the roughly 4.5 million S corporations operating in the United States.

Cost of H.R. 4453

The staff of the Joint Committee on Taxation (JCT) estimates that enacting H.R. 4453 would reduce revenues, thus increasing federal deficits, by $1.5 billion over the 2014-2024 period.

Additional Info

The Latest

-

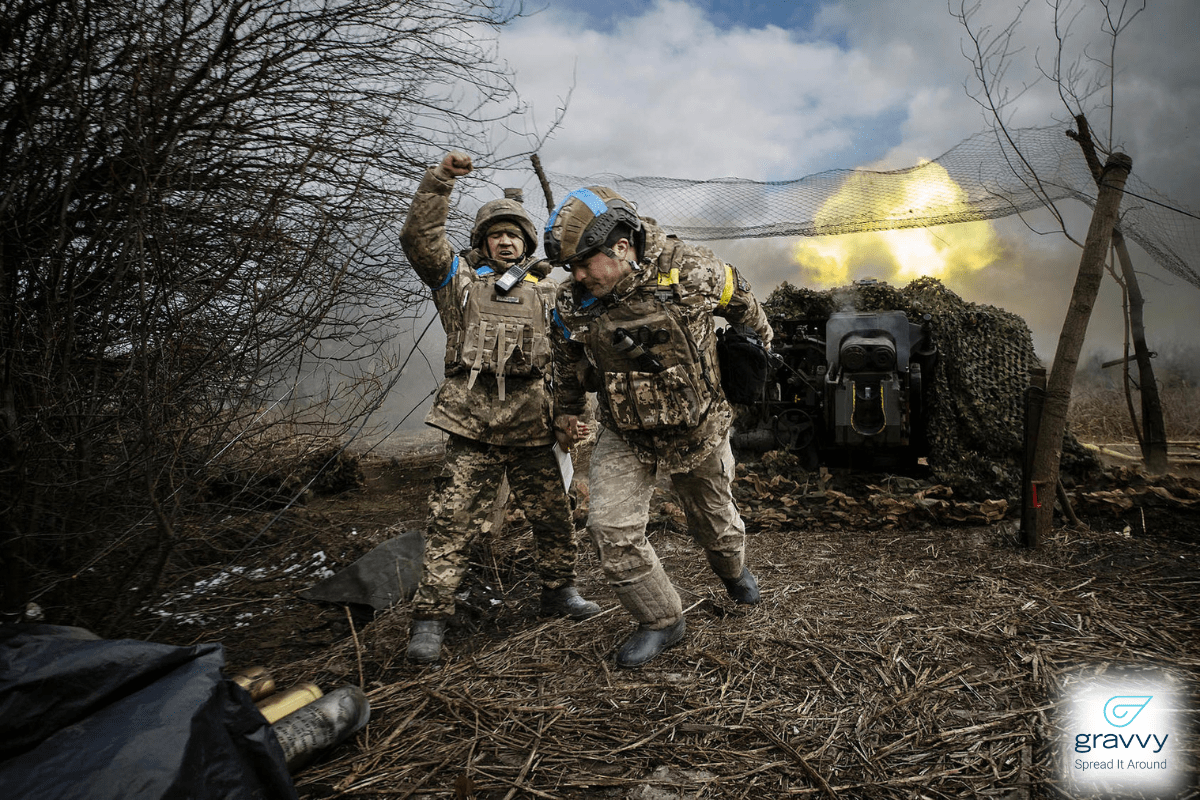

How To Help Civilians in UkraineHeavy shelling and fighting have caused widespread death, destruction of homes and businesses, and severely damaged read more... Public Safety

How To Help Civilians in UkraineHeavy shelling and fighting have caused widespread death, destruction of homes and businesses, and severely damaged read more... Public Safety -

The Latest: Israel Evacuates Rafah, Palestinian Place of RefugeUpdated May 6, 2024, 12:00 p.m. EST The Israeli military is telling residents of Gaza who have sought shelter in Rafah to read more... Israel

The Latest: Israel Evacuates Rafah, Palestinian Place of RefugeUpdated May 6, 2024, 12:00 p.m. EST The Israeli military is telling residents of Gaza who have sought shelter in Rafah to read more... Israel -

Trump Hush Money Trial Enters Third Week, Strategy to ‘Deny, Deny, Deny’Updated May 6, 2024, 11:00 a.m. EST The criminal trial to determine whether Trump is guilty of falsifying records to cover up a read more... Law Enforcement

Trump Hush Money Trial Enters Third Week, Strategy to ‘Deny, Deny, Deny’Updated May 6, 2024, 11:00 a.m. EST The criminal trial to determine whether Trump is guilty of falsifying records to cover up a read more... Law Enforcement -

IT: Battles between students and police intensify, and... 💻 Should we regulate AI access to our private data?Welcome to Thursday, May 2nd, listeners... The battle between protesters and police intensifies on college campuses across the read more...

IT: Battles between students and police intensify, and... 💻 Should we regulate AI access to our private data?Welcome to Thursday, May 2nd, listeners... The battle between protesters and police intensifies on college campuses across the read more...

Climate & Consumption

Climate & Consumption

Health & Hunger

Health & Hunger

Politics & Policy

Politics & Policy

Safety & Security

Safety & Security