The GOP Budget for Fiscal Year 2018 and Using Reconciliation for Tax Reform and Deficit Reduction (H. Con. Res. 71)

Do you support or oppose this bill?

What is H. Con. Res. 71?

(Updated June 18, 2021)

(Updated 10/24/17): The Senate amended this resolution before passing it on October 19th by removing the requirement that tax reform legislation be deficit-neutral and allowing for up to $1.5 trillion in additional tax cuts; increasing defense spending caps; and eliminating the requirement for the House Budget Committee to produce savings under reconciliation. An additional bipartisan amendment eliminated future vote-a-ramas from the budgeting process. The House then passed that version of the budget resolution.

The House-passed version of this resolution would outline a $3.1 trillion budget for fiscal year 2018 and provide reconciliation instructions for the House Ways and Means Committee to produce deficit-neutral tax reform legislation, and other committees to produce legislation reducing deficits by $203 billion over a 10-year period. Budget levels for future fiscal years would be set to shrink the deficit over time and bring the budget into balance by 2027.

Federal spending for fiscal year 2018 would be set at $3.16 trillion, while tax revenue to the government would be $2.67 trillion, resulting in a deficit exceeding $494 billion. In future years the deficit is set to shrink over time to $359 billion in 2021 and $144 billion in 2025, before the budget balances and a surplus of about $4.9 billion is achieved in 2027.

The resolution would give reconciliation instructions to 11 House committees to produce legislation reducing the deficit by $203 billion over the 10 year budget window by October 6, 2017. The largest reductions would come from the Ways and Means Committee ($52 billion), the Judiciary Committee ($45 billion), and $20 billion each from the Education & Workforce Committee and the Energy & Commerce Committee.

The resolution would also reserve funds to be used for commercializing the air traffic control system, investing in national infrastructure, providing for tax reform, funding the State Children’s Health Insurance Program, and repealing and replacing Obamacare.

As a concurrent resolution, this legislation can’t become law so it wouldn’t go to the president’s desk for a signature. It's essentially Congress expressing its views on a policy matter - in this case on the budget, tax reform, Obamacare, and other programs. It doesn’t authorize any actual spending, instead it simply lays out budget levels that appropriators will have to work within.

Argument in favor

The American economy needs a boost from comprehensive, deficit-neutral tax reform and this budget resolution would let Congress use the reconciliation process to achieve that.

Argument opposed

Tax reform could be beneficial, but this budget resolution opens the door for Republicans to produce and pass an overhaul of the tax code in a partisan manner that excludes Democrats.

Impact

The federal government and relevant congressional committees.

Cost of H. Con. Res. 71

A CBO cost estimate is unavailable.

Additional Info

In-Depth: House Budget Committee Chairman Diane Black (R-TN) released the following statement on the introduction of this budget resolution:

“The House Republican Budget, ‘Building a Better America,’ does just that. It will lay out a path to balance, promote job creation, give our military the resources they need to protect our nation, and hold Washington accountable. This budget also sets out reconciliation instructions to fix our broken tax code and make long-overdue reforms to mandatory spending. The status quo is unsustainable. A mounting national debt and lackluster economic growth will limit opportunity for people all across the country. But we don’t have to accept this reality. We can move forward with an optimistic vision for the future and this budget is the first step in that process. This is the moment to get real results for the American people. The time for talking is over, now is the time for action.”

House Democrats expressed their opposition to this budget resolution and the tax reform legislation that would be produced by House through the reconciliation process:

“Nearly two months ago we debated President Trump’s budget. It was a shockingly extreme document that gave to the rich and took from everyone else… But this budget again displays total indifference to the challenges Americans face. The House budget embraces the worst extremes of the Trump proposal: tax cuts for millionaires and billionaires at the expense of American families, our economic progress, and our national security. The budget includes $5.4 trillion in mandatory and discretionary spending cuts. It reduces non-defense discretionary investments to the lowest level, relative to the size of the economy, since the 1960s, and then cuts more.”

Media:

-

House Budget Committee Press Release

-

House Budget Committee Additional Resources

-

Bloomberg BNA

-

Successful Farming

Summary by Eric Revell

(Photo Credit: alfexe / iStock)The Latest

-

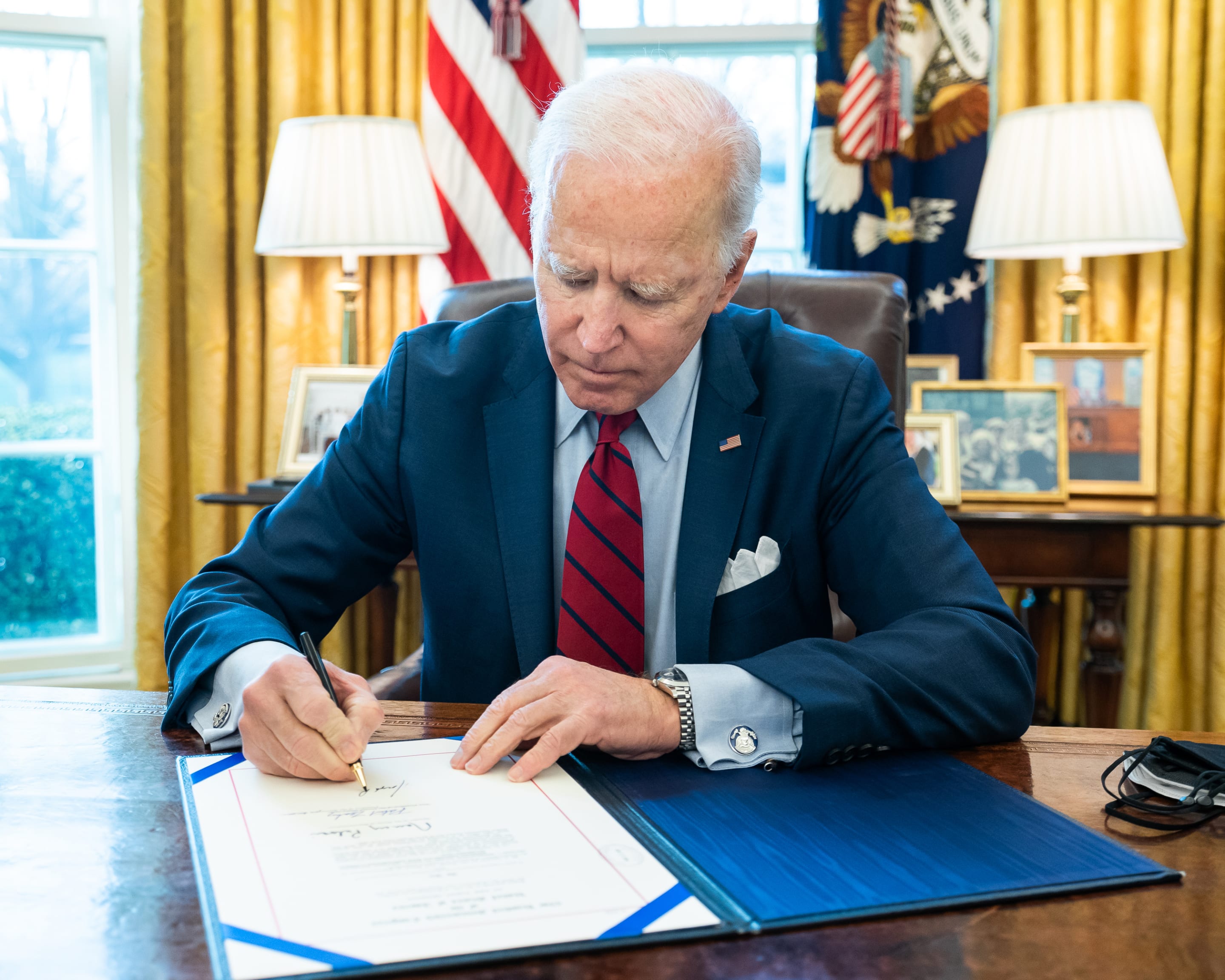

Biden Signs Ukraine, Israel, Taiwan Aid, and TikTok BillWhat’s the story? President Joe Biden signed a bill that approved aid for Ukraine, Israel, and Taiwan, which could lead to a ban read more... Taiwan

Biden Signs Ukraine, Israel, Taiwan Aid, and TikTok BillWhat’s the story? President Joe Biden signed a bill that approved aid for Ukraine, Israel, and Taiwan, which could lead to a ban read more... Taiwan -

Protests Grow Nationwide as Students Demand Divestment From IsraelUpdated Apr. 23, 2024, 11:00 a.m. EST Protests are growing on college campuses across the country, inspired by the read more... Advocacy

Protests Grow Nationwide as Students Demand Divestment From IsraelUpdated Apr. 23, 2024, 11:00 a.m. EST Protests are growing on college campuses across the country, inspired by the read more... Advocacy -

IT: Here's how you can help fight for justice in the U.S., and... 📱 Are you concerned about your tech listening to you?Welcome to Thursday, April 18th, communities... Despite being deep into the 21st century, inequity and injustice burden the U.S. read more...

IT: Here's how you can help fight for justice in the U.S., and... 📱 Are you concerned about your tech listening to you?Welcome to Thursday, April 18th, communities... Despite being deep into the 21st century, inequity and injustice burden the U.S. read more... -

Restore Freedom and Fight for Justice With GravvyDespite being deep into the 21st century, inequity and injustice burden the U.S., manifesting itself in a multitude of ways. read more... Criminal Justice Reform

Restore Freedom and Fight for Justice With GravvyDespite being deep into the 21st century, inequity and injustice burden the U.S., manifesting itself in a multitude of ways. read more... Criminal Justice Reform

Climate & Consumption

Climate & Consumption

Health & Hunger

Health & Hunger

Politics & Policy

Politics & Policy

Safety & Security

Safety & Security